Best NPS Fund Managers 2024: The National Pension Scheme (NPS) is widely recognized as a major component of pensions in India. This scheme was implemented by the central government as a social security service extended to all citizens of India. Individuals with businesses in the public and private sectors are allowed to invest through NPS in risk-free securities, safety deposits, or other investments that offer good returns. Investing in NPS will provide you with a competitive advantage in fixed income structure and some form of accounting or tier-1 or tier- 2, based on Section 80C and Section 80CCD of the Income-tax Act, 1961, respectively. In this article, we will be explaining more about the best NPS fund managers of 2024 that you must know in detail.

In addition, a pension plan gives you control over the distribution of your savings. The system offers a choice of manual or automatic currency. The Active option allows users to choose the budget and the appropriate amount to allocate. In contrast, the auto option allocates investments according to the age and risk tolerance of the user. In 2024, you need to consider several factors to determine which NPS fund manager best matches your financial goals and risk tolerance. The National Pension Scheme (NPS) is a pension scheme available to Indian citizens between the ages of 18 and 70, including NRIs and OCIs in Asset Class A, Asset Class C, and Asset Class G, and four banks provided by the NPS.

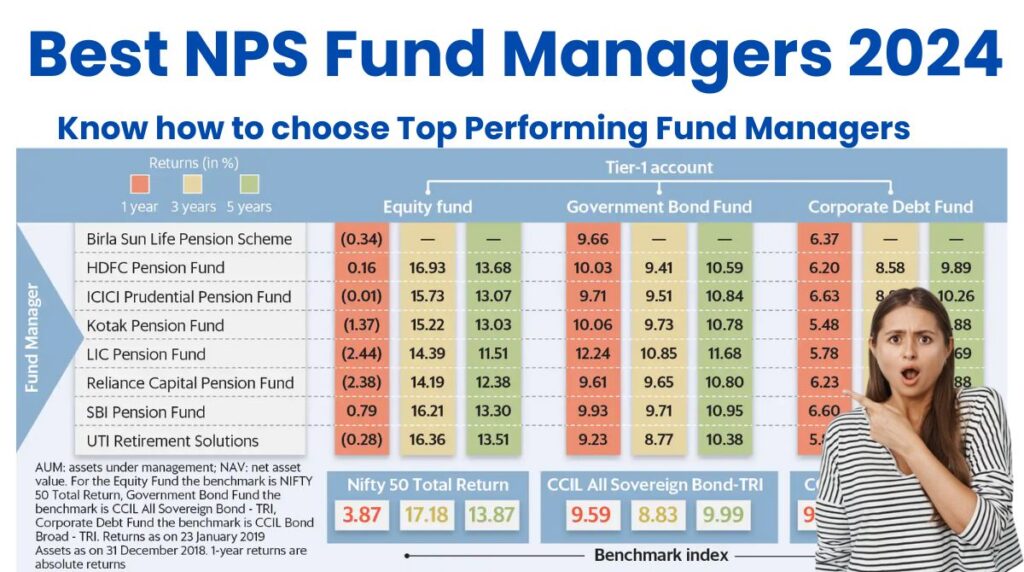

Consider your investments and risk tolerance when choosing a value-oriented fund manager. In order to make informed choices, it is necessary to analyze existing results. A few examples of pension fund managers who have consistently performed well include SBI, HDFC, UTI, and ICICI Pru. The ICICI Pru Pension Fund Management Company Limited has shown strong returns over a number of periods. You can change your fund manager with NPS once a year if you feel it is necessary. Conduct basic portfolio research and get the best returns from a fund manager that suits your interests. Section 80C exempts investments up to Rs 150,000, and Section 80CCD exempts another Rs 50,000 from tax. So, let us start with an overview table.

Best NPS Fund Managers 2024 – Overview

| Scheme Name | National Pension Scheme (NPS) |

| Scheme Benefits | Indian Citizens, NRIs, and OCIs |

| Country | India |

| Year | 2024 |

| NPS Fund Managers | SBI, HDFC, Kotak, UTI, and ICICI Pru |

| Top NPS Fund Manager | ICICI Pru Pension Fund Management Company Limited |

| Section 80C Tax Exemptions (Max) | Rs. 1,50,000 |

| Section 80CCD Additional Tax Exemptions (Max) | Rs. 50,000 |

| Age Limit (Min) | 18 years |

| Age Limit (Max) | 70 years |

| NPS Account | Required |

| NPS Fund Types | Asset Class E, C, G, and A |

| Fund Manager Required (No.) | 1 |

| Fund Manager Accounts | Tier 1 and Tier 2 |

| Other Details | Check Article |

As we have already mentioned earlier, the National Pension Scheme, or NPS, is applicable to all Indian citizens with an age limit of at least 18 years and a maximum of 70 years as an eligibility criteria. Also, you must have a NPS account that must be created if you don’t want to avail of this exciting scheme. There are several NPS fund managers, but in a year, only one fund manager is required, and ICICI Pru Pension Fund Management Company Limited is the only company that is required to manage funds in 2024. There are other NPS fund managers as well, as we stated in this article twice; hence, please read this article from start to finish for a better understanding of the term “National Pension Scheme,” or NPS. Through this whole article, you will get all the necessary information related to NPS and the fund managers that you are required to know in detail.

Best NPS Fund Managers 2024 – Choosing NPS Fund Managers

LIC is the third-best fund provider after HDFC and Aditya Birla. LIC with 8.58 percent, HDFC with 8.79 percent, and Aditya Birla with 7.93 percent. NPS offers four types of assets: government bonds (Class G), commercial loans (Class C), other investments (Class A), and stock bonds (Class E). Risk returns for each type vary. Since NPS allows you to choose different fund managers for each property type, you can choose the best one for each. SBI is the best NPS provider for Tier I equity schemes. HDFC is best for the Tier 1 government mortgage scheme, LIC is best, and SBI is best for the Tier 1 business bond scheme. You can choose a professional pension fund manager across all asset classes if you want to keep things simple. HDFC, for example, has consistently performed well across all asset classes.

Best NPS Fund Managers 2024 – Eligibility Criteria

Following are the eligibility criteria that you are required to know in detail to become eligible for acquiring this scheme:

- You must be an Indian citizen, including non-Indian residents, to open an account with the National Pension Scheme (NPS).

- You must be at least 18 years old and a maximum of 70 years old to become eligible to open an account with NPS.

- You must provide certain Know Your Customer, or KYC, documents that are valid to open an account with NPS.

- You must contribute some amount as a minimal yearly contribution to the NPS scheme, which is said to be for only Rs. 1000, to be eligible for opening an account with NPS.

NPS plans allow investment in various assets, such as stocks, bonds, and other investments, because they are market-linked. After completion of asset mix and portfolio management, funds are distributed according to the specific arrangements in the four asset classes mentioned earlier.

Best NPS Fund Managers 2024 – Duties

Fund managers invest their investments in assets in order to maximize returns with appropriate risk. While investing income from investors, the investment policy should follow the rules of PFRDA. Investors’ investment strategies and risk profiles determine how fund managers use assets across asset classes. They are trying to maximize revenue and minimize risk. NPS fund managers monitor investment performance to maximize returns. This involves monitoring portfolio investments and making adjustments to increase returns.

Best NPS Fund Managers 2024 – Meaning

NPS fund managers will allocate National Pension System (NPS) assets to asset classes based on client budgets and risk profiles by 2024. These fund managers allocate funds between stocks, government bonds, and corporate debt, with additional funding invested to maximize return and minimize risk.

Frequently Asked Questions – Best NPS Fund Managers 2024

Ans: The full form of the NPS is the National Pension Scheme.

Ans: There are several, but ICICI Pru Pension Fund Management Company Limited is the top-performing NPS fund manager.

Ans: The minimum age limit to open an NPS account is 18 years old.