Minimum Salary for Personal Loan: Those who prefer a credit score of 750 or more are seen as more responsible with their money and less likely to make payments. Thus, personal loans are the preferred method of repayment for these borrowers among banks and non-banking finance companies, or, in short, NBFCs. A good credit score usually means a lower interest rate when applying for a personal loan. Personal loans can be obtained from a handful of lenders even though credit scores are weak and interest rates are high. So, it’s important for candidates to check their credit scores frequently and do what’s necessary to get closer to 900. In this article, we will explain personal loans and their eligibility criteria with a minimum salary.

Minimum score requirements for personal loans can vary from one lender to another. Nonetheless, prospective borrowers without credit scores or who are new to the loan program may be eligible for personal loans from certain lenders. Lenders differ in their minimum interest rates for personal loans. There are lenders with minimum salary requirements of less than $20,000 per year and others that are larger. Also, low-income borrowers are still eligible for a personal loan as long as they have a stable job, expenses, a manageable income, and no negative marks on their credit records. A photograph, proof of residency, bank statements, proof of age when applying for a personal loan, proof of income, and other supporting documents are needed.

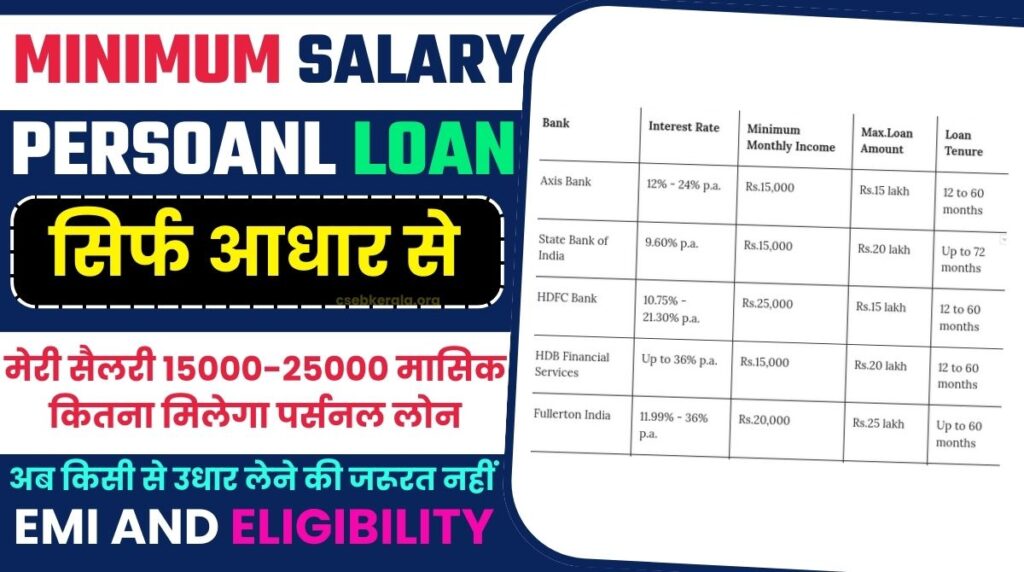

Applicants can submit all the required information and fill out the online application form through the lender’s website or platform, including CreditMantri. While interest rates can be high, low-income people with poor credit may qualify for a personal loan anyway. You can also download the application form in PDF format, and a printout of that form can be easily taken for future reference or use. There are several banks that provide loans or loan-related schemes to their eligible members, and these banks include Axis Bank, HDFC Bank, ICICI Bank, Indusind Bank, and so on. Below is an overview table that will give you an idea of the minimum salary for a personal loan and many more details you must know.

Minimum Salary for Personal Loan – Overview

| Loan Type | Personal Loan |

| CIBIL Credit Score | Mandatory |

| CIBIL Credit Score Range | 300 to 900 |

| Eligibility Criteria | Apply if Eligible |

| Application Mode | Online |

| Application Form Download Format | |

| Application Form Printout | Available |

| Salaried Age Limit (Min) | 18 years |

| Salaried Age Limit (Max) | 60 years |

| Self-employed Age Limit (Min) | 21 years |

| Self-employed Age Limit (Max) | 65 years |

| Salaried Minimum Income (Monthly) | Rs. 15,000 |

| Self-employed Minimum Income (Yearly) | Rs. 15,00,000 |

| Credit Score Required | 750 or Above |

| Other Details | Check Article |

As we have already mentioned earlier, banks and several financial institutions, including NBFCs, will provide personal loans to those who are in urgent need of funds, and for that, several banks or financial institutions may or may not ask for the CIBIL credit score, and those scores must be at least 750 or higher. You can apply for a personal loan if you are eligible, and the eligibility criteria include your age limit, the salary that you are earning from your company, or the income that is generated from your business. You must be at least 18 years old and a maximum of 60 years old to apply for a personal loan if you are a salaried person, and you must be at least 21 years old and a maximum 65 years old to apply for a personal loan if you are a businessperson. When we talk about income, your income as a salaried employee must be at least Rs. 15,000 per month, and your income as a businessperson must be at least Rs. 15,00,000 per annum. For more information, continue reading this article fully for better understanding.

Minimum Salary for Personal Loan – Eligibility Criteria

Following are the eligibility criteria that you are required to know to apply for a personal loan at any of the reputed banks or financial institutions:

- You must be at least 18 years old and a maximum of 60 years old to apply for a personal loan as a salaried person.

- You must be at least 21 years old and a maximum of 65 years old to apply for a personal loan as a businessperson.

- You must be earning an income of Rs. 15,000 per month as a salaried person.

- You must be earning an income of Rs. 15,00,000 per annum as a businessperson.

- You must have at least 1 year of work experience with some lenders as a salaried person.

- As a businessperson, you must have at least 3 years of business experience with some of the reputed lenders.

- You must have a CIBIL credit score of 750 or higher to apply for a personal loan as a salaried or businessperson.

If you have followed the above-mentioned criteria, whether you are a salaried person or a businessperson, you can easily apply for a personal loan without any fear and from the comfort of your home, wherein your loan amount will be approved faster and it will be received within a few hours or even a day into your respective bank account.

Minimum Salary for Personal Loan – How to Apply?

Following are the important steps or points that you are required to know to apply for a personal loan from any of the banks or financial institutions that provide instant loans to customers via loan offers:

- First of all, you must understand and follow all the eligibility criteria that we have already mentioned via the pointers above.

- Then, you need to prepare necessary documents like ID proof, address proof, income proof, and other legal documents that are required by the lenders, who might be either banks or any financial institutions like NBFCs.

- Now, you are required to select a lender based on your criteria and preferences and consider a few factors, like credit score requirements that must be at least 750 and above for instant loan approval, interest rates, and so forth.

- Next, you must complete your application procedure, which can be easily done via the online method, which means you can log in to any of the bank’s or financial institutions’ websites and apply with the procedure that we know and have already mentioned in our previous articles on personal loans or CIBIL scores. You can also visit any of the nearest bank branches for the application method.

- Finally, you need to wait for the approval, and once the approval is done by the authorities, the amount will automatically be received on your respective bank accounts.

Frequently Asked Questions – Minimum Salary for Personal Loan

Ans: The minimum age for a salaried person to apply for a personal loan is 18 years.

Ans: The minimum age for a businessperson to apply for a personal loan is 21 years.

Ans: A salaried person must earn at least Rs. 15,000 per month to apply for a personal loan.