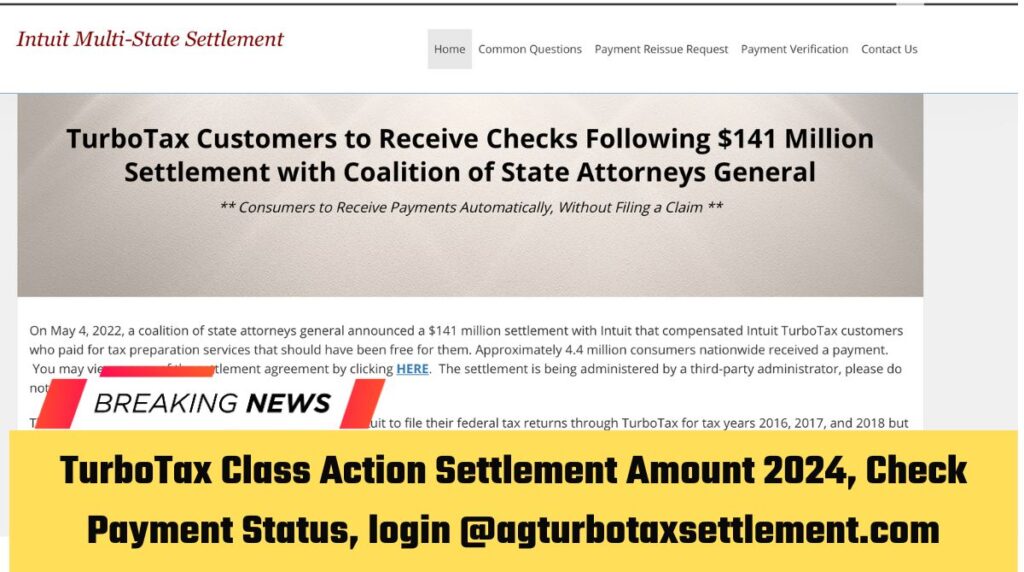

TurboTax Class Action Settlement Payment 2024: The TurboTax class action settlement payout aims to compensate individuals who utilized TurboTax to file their federal tax returns for the years 2016, 2017, and 2018, but actually qualified for free filing under the IRS Free File Program. The eligibility criteria apply to taxpayers who made payments to file their federal tax returns using TurboTax during the specified tax years and were eligible for the complimentary version offered through the IRS Free File program. In this article, we will be explaining all the details that are related to the TurboTax Class Action Settlement Payment 2024 and who will be eligible for the payment this year. So, let us get started.

If you meet these requirements, you may be entitled to receive a maximum of $85 if you paid for TurboTax services throughout all three designated tax years. In May 2023, a third-party administrator was responsible for overseeing the distribution process and automatically sending out settlement amounts to eligible customers. The payments ranged from $29 to $30, with most clients receiving this amount. It’s important to note that the exact payment may slightly differ based on the total number of qualified claims. All disbursements were sent by mail during the entire month of May 2023. New York Attorney General Letitia James announced that TurboTax’s parent company, Intuit, has agreed to settle $141 million to reward about 4.4 million customers in all 50 states and the District of Columbia.

The recent settlement is a result of allegations against Intuit for using deceptive marketing tactics. They falsely promoted tax-filing services as free to customers who did not actually qualify for such services due to specific tax circumstances. This predatory and misleading strategy has had an out of proportioned impact on economically disadvantaged Americans who have an obligation to fulfill their tax filing responsibilities. The purpose of the settlement is to address this issue and provide compensation to those who were misled into paying for supposedly free services. Below is the overview table that will give you a proper idea of the TurboTax Class Action Settlement Payment 2024 and other details that you are required to know in depth.

Table of Content

TurboTax Class Action Settlement Payment 2024 – Overview

| Settlement Payment Name | TurboTax Class Action Settlement Payment |

| Year | 2024 |

| Benefits | Taxpayers Filed Tax Returns |

| Filed Tax Returns Years | 2016, 2017, and 2018 |

| Eligible Members | Taxpayers |

| Payment Amount | $85 |

| Duration | 3 years |

| Eligible for Free File | Payments Mailed |

| Mailed Date | May 2023 |

| Distribution Procedure Amount | Between $29 and $30 |

| Notifications | Announced by Email |

| Organizer | Settlement Fund Administrator |

| Tax Body | Internal Revenue Service (IRS) |

| Exact Amount | Vary |

| Other Details | Check Article |

As we have already mentioned in this overview table, the taxpayers who have filed tax returns from 2016 until 2018 are beneficial for the amount that they will get this year, i.e., 2024. When we explain about the distribution procedure, the automatic payment is given via check and most of the taxpayers get the amount between $29 and $30. For more information, just continue reading this article fully for better understanding.

- TOP 6 Retirement Regrets in USA and Canada

- TurboTax Class Action Settlement Amount 2024

- King Charles III Diagnosed With Cancer

TurboTax Class Action Settlement Payment 2024 – Who is Eligible?

TurboTax Settlement eligibility requirements apply to individuals who used TurboTax to file their federal tax returns for 2016, 2017, and 2018, but qualify for the no-cost version offered through the IRS Free File program. Here are the specific eligibility criteria, if you know:

- Taxpayers must have paid the settlement amount to file their federal Turbo Tax returns from 2016 until 2018 tax years, i.e., for 3 whole years.

- Taxpayers must have been qualified for the free file option during the mentioned 3 years (2016-2018).

- Eligible taxpayers can use TurboTax’s free version at the beginning if they have already begun their tax filing procedures.

- Taxpayers must also qualify for a settlement amount that has no Intuit’s free-file product in any last year prior to the tax year that they are claiming as eligibility.

So, these are the eligibility criteria that you must know, as it is very important for you to know them in a better way.

TurboTax Class Action Settlement Amount

Intuit has recently come to a resolution, agreeing to pay a total of $141 million in order to settle the allegations that have been made against them. This settlement fund has been established with the purpose of providing compensation to approximately 4.4 million eligible customers residing in the United States.

The amount that each customer will receive from this fund is determined based on the number of tax years in which they meet the specific criteria outlined in the settlement agreement. It is anticipated that most participants will receive an estimated amount ranging from $29 to $30 for each qualifying tax year.

However, it’s important to note that this figure may slightly fluctuate depending on factors such as the overall number of qualified claimants and any administrative costs associated with distributing the settlement funds. Nevertheless, the primary objective here is to ensure that these funds are allocated fairly and impartially among those who have been affected by these circumstances.

TurboTax Class Action Settlement Payment Distribution Process

Eligible clients can expect to receive a comprehensive cash distribution as part of the TurboTax settlement. The process is designed to be automated, ensuring that payments are directly sent to eligible individuals based on the information available to the settlement administrators. Rust Consulting, the administrator of the settlement fund, will notify eligible customers via email. The distribution of checks is scheduled to commence in May 2023.

Frequently Asked Questions – TurboTax Class Action Settlement Payment 2024

Ans: Rust Consulting will notify taxpayers via email for payment.

Ans: There is no exact amount that taxpayers will get from the TurboTax Class Action Settlement Payment, as it varies.

Ans: Yes, the notifications on the payment will be received via email.