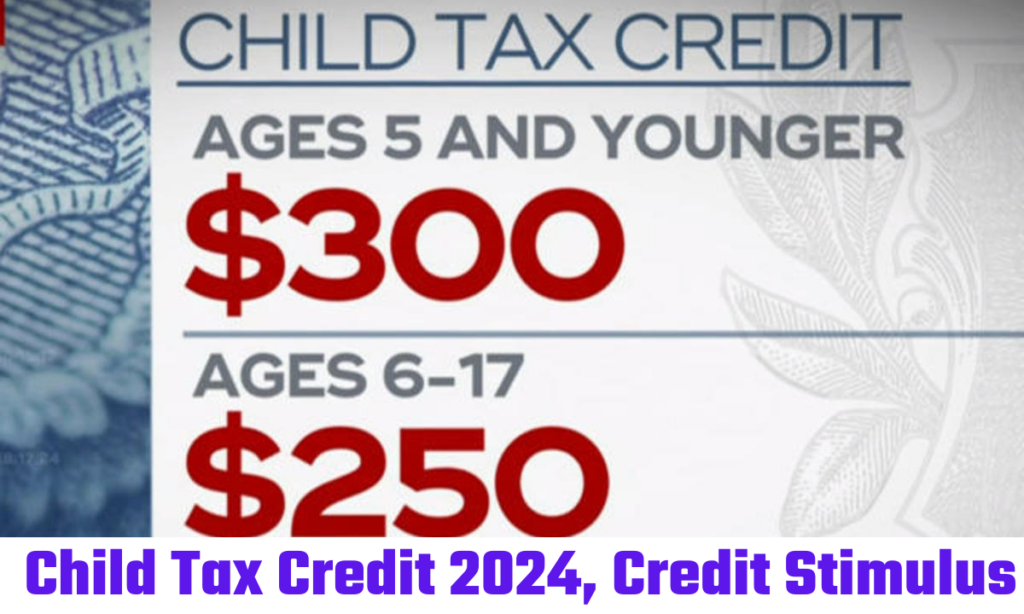

Child Tax Credit 2024: The Internal Revenue Service (IRS) has announced that they will start accepting and processing income tax returns on January 29, 2024. Those claiming the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) should expect to receive their refunds no earlier than February 27, 2024. The child tax credit is a way to help those who have the added expense of raising children. This program gives taxpayers a reduction in the amount of tax that they owe and provides them with some government benefits, up to $2,000 for each qualifying individual. This tax credit will go up in 2024 because of yearly inflation, and it will also be refundable, so claimants whose tax bill is less than $0 will receive that amount as a tax refund.

It’s a valuable resource for families looking for some extra financial assistance. The IRS child tax credit is a valuable aid for low-income taxpayers and their families, helping to alleviate the financial burden of living expenses. In the year 2024, there are plans to further boost this credit, aiming to improve the economic well-being of both children and households. The Child Tax Credit (CTC) for 2024 is set to experience a significant increase, with a maximum amount of $1700. These credits serve as a substantial annual investment, amounting to billions of dollars. For more information, I recommend checking out the official IRS website or staying updated with the latest news on the Child Tax Credit extension bill. It’s always a good idea to stay informed about any changes regarding this topic.

The Child Tax Increment 2024 offer must meet the eligibility requirements of eligible taxpayers and their children. Additionally, a taxpayer must meet certain income requirements to receive a CTC payment. The child will receive a Child Tax Credit worth 2000 USD in 2024 if the taxpayer has a combined income of $400,000 USD and 200,000 USD for the new filing. Additionally, the new CTC also costs $1,600. Below is the overview table that will give you a brief idea of the Child Tax Credit (CTC) and all other details related to CTC, especially the tax return received date and many more details to know. So, let’s get started without delaying any further.

Child Tax Credit 2024 – Overview

| Tax Credit Name | Child Tax Credit (CTC) |

| Year | 2024 |

| Purpose | Provides Financial Relief to Low-income Families |

| Refundability Status | Fully Refundable |

| Refundable Amount (Old) | 1700 USD |

| Refundable Amount (New) | 1600 USD |

| Age Limit (Now – Minimum) | 17 years |

| Age Limit (Then – Minimum) | 16 years and Below |

| Maximum Credit Amount | 3600 USD (Below 5 years) and 3000 USD (Above 5 and Below 18) |

| Income Limit (Amount) | 400,000 USD (If Gross Income Exceeds) |

| CTC Official Announcement | Internal Revenue Service (IRS) |

| Tax Return Filing (Last Date) | 15th April 2024 |

| CTC Amount (Expected) | 2000 USD |

| Updates and Inquiries | Visit Official Website of IRS |

| Official Website (IRS) | https://www.irs.gov/ |

As a citizen of the United States of America, you can check out the official website of the IRS, which is mentioned in the overview table above, for any latest updates and inquiries. The Child Tax Credit amount will be fully refundable, and it will be refundable to all those who are currently 17 years of age or younger. The refundable amount at present is 1600 USD, whereas 1700 USD was before. If the gross income exceeds the income limit of 400,000 USD, then the amount will be reduced.

Child Tax Credit 2024 – What is Child Tax Credit (CTC)?

The Child Tax Credit (CTC) serves as a valuable financial aid for taxpayers with a dependent child under 17 years old. It effectively reduces the amount of tax that needs to be paid, and in some cases, it can even eliminate the tax liability entirely. Furthermore, eligible taxpayers may also be entitled to receive a partial refund through the extra child tax credit.

Child Tax Credit 2024 – What is CTC Extension Bill?

The legislation known as the Child Tax Credit Extension Bill aims to expand the reach of the Child Tax Credit. This proposal, called the Tax Relief for American Families and Workers Act of 2024, is a bipartisan effort to enhance the Child Tax Credit. The proposed changes include introducing an indexing system tied to inflation for determining the base credit amount, increasing the maximum refundable amount per child, and extending eligibility to include 17-year-olds. However, it’s important to note that this measure is still pending and its future implementation remains uncertain. It’s worth mentioning that in 2021, the American Rescue Plan temporarily raised the Child Tax Credit for a single year.

Child Tax Credit 2024 – CTC Return Receiving Date

When it comes to filing taxes online and opting for direct deposit, most taxpayers can expect to receive their Child Tax Credit refund on February 27, 2024. However, due to the Safeguarding Americans from Tax Hikes (PATH) Act, those who claim the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) may experience a longer wait for their refunds. This is because the IRS is required by law to take extra time to prevent fraudulent returns. To track the progress of their return, taxpayers can use the “Where’s My Refund?” option that is available on the IRS website. It’s important to note that the Child Tax Credit Extension Bill is currently just a proposed law and has not been signed into law yet.

Child Tax Credit 2024 – Anticipated CTC Increase

The anticipated implementation of the Child Tax Credit Increase in the United States of America is expected in the upcoming fiscal year of 2024. The Internal Revenue Service is currently exploring options to enhance the child tax credit, providing a generous sum of $2,000 for each eligible child. Furthermore, there is a potential opportunity for an additional $1,700 return per subsequent child.

Frequently Asked Questions – Child Tax Credit 2024

Ques: Where will the Child Tax Credit be applicable?

Ans: The child tax credit will be applicable in the United States of America.

Ques: What is the current refundable amount for the Child Tax Credit?

Ans: The current refundable amount for the Child Tax Credit is 1600 USD.

Ques: When will the CTC amount be refunded in 2024?

Ans: The CTC amount will be refunded on February 27, 2024.

![$1400 Direct Stimulus Check Deposit Date, Eligibility & Check Payment Dates [May-April] $1400 Direct Stimulus Check Deposit Date, Eligibility & Check Payment Dates [May-April]](https://www.csebkerala.org/wp-content/uploads/2024/04/Copy-of-Copy-of-Aadhar-1024x572.jpg)